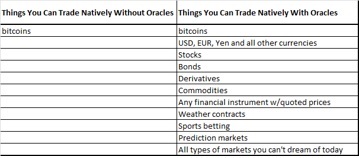

One topic that I believe is under-studied, under-invested and generally under-played in the world of Bitcoin is that of oracles. Bitcoin is a spectacularly smart global decentralized open programmable value network that can natively trade any asset without counterparties so long as that asset is bitcoins, a currency that is a unit of account in exactly zero economies.

On the other hand, once you want to trade in instruments related to the existing financial system (currencies, stocks, bonds, etc), you are back in the world of issuers, counterparties and slow moving centralized organizations.

Oracles (today, mostly at the concept level) propose an incredibly useful solution to this topic. Imagine an arbitrary number of sources (each with different level of user-determined/rated trustworthiness) broadcasting, for lack of a better world, financial, political, weather and state-of-the-world information in a format that could be incorporated into Bitcoin contracts. Once that exists (and it will), you will have an explosion of decentralized financial instruments executing over the Bitcoin network.

Here are some sample contracts you could design to work natively on the Bitcoin blockchain in a world of oracles:

(1) Call options on IBM shares where price is determined by the end-of-day values provided by the following 5 oracles: Google, Bloomberg, Financial Times, Thomson Reuters and Wall Street Journal. If less than 4 of the 5 agree, cancel the contract.

(2) Weather derivatives that pay out based on the average rainfall in Maine as measured by the average of [the National Weather Service oracle] and [at least 100 Weather Underground Stations oracles]

(3) Election contracts based on majority [5,000 out of 7,000] oracles on who the President of the USA is in 2020

(4) Futures contracts on electricity prices from distributed solar generators in San Francisco for your self-flying Jetsons car

And so on. I summarize this concept in this chart below.

Side-note 1: Yes, you probably need some long exposure to bitcoin for this to work today and/or well developed ways to also hedge BTC-[your currency] risk during the contract period but either seems plausible by the time this exists

Side-note 2: Yes, this is not totally decentralized but could be quite decentralized for things like "who won the Super Bowl" and reasonably decentralized for "what is the price of IBM stock EOD today?". On the whole, probably at least as decentralized as mining is, if not much more so.

Side-note 3: Could be a nice monetization model for some sensor networks

For the full Bitcoin series: ledracapital.com/bitcoin

Follow us on Twitter: @polemitis and @ledracapital

Facebook: facebook.com/ledracapital

Email Newletters: ledracapital.com/subscribe

Important disclaimer: ledracapital.com/btcdisclaimer