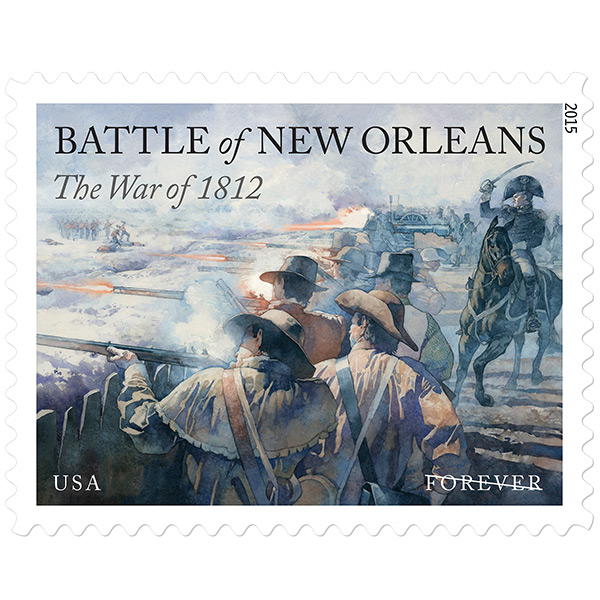

US Forever stamp, circa 2015.

In Bitcoin

- A lot of ink has been spilled on the cost of a 51% attack* on the current Bitcoin ledger.

* an attack that would allow parts of the ledger to be re-written

- Most attempts to do a pure calculation of the computing power needed come up with estimates in the range of a few hundred million dollars

- Others argue with those estimates

- Others say in a few years it will be billions of dollars

- Others say that if existing miners collude it might be cheaper

- Other say that miners aren't incented to attack the chain due to the diminished value of their Bitcoin future revenue stream

- And so on

I personally think the explicit or implicit cost is well above $100M and rising, but the debate will go on for a while.

In a traditional financial ledger:

By contrast, it is extremely easy to calculate the cost of a 51% attack on a traditional financial services ledger.

In the United States, circa 2015, it is $0.49, or the cost of one 1st class stamp.

This stamp needs to be attached to a letter addressed to the CFO of a financial services firm and would have one of the following as the sender:

- IRS

- Treasury

- OFAC

- Federal Reserve Board

- FDIC

- OCC

- SEC

- A variety of state regulators in your state of choice

- A variety of three letter agencies

- A federal court

- A state court

- An insurance commissioner

I am not judging one model vs. the other as they each have their uses. But I am comfortable saying that subverting a traditional ledger is a few orders of magnitude less expensive than subverting a decentralized one.*

* What if a three letter agency sent letters to miners ordering them to collaborate to execute an attack on Bitcoin? I don't know how realistic that is but, to the degree it is realistic, it is an excellent argument for them being distributed. This is why I don't worry about stories of miners at the Mongolian border of China leaching electricity from state-owned enterprises and hurting the ROI of other miners. The more miners, the more dispersed the miners, the more jurisdictions that they operate in, the safer the Bitcoin ledger is.

For the full Bitcoin series: ledracapital.com/bitcoin

Follow us on Twitter: @polemitis and @ledracapital

Facebook: facebook.com/ledracapital

Email Newletters: ledracapital.com/subscribe

Important disclaimer: ledracapital.com/btcdisclaimer